Exploring GME in the German Market: Insights, Performance, and Investment Potential

Introduction

GameStop Corp. (GME) has been a focal point in the global stock market, especially following the unprecedented retail trading frenzy in early 2021. While much attention has been on the U.S. markets, GME has also seen significant activity in international markets, including Germany. This blog post delves into the presence and performance of GME in the German market, providing a comprehensive analysis for potential investors.

What is GME?

GME, or GameStop Corp., is a global retailer of video games, consumer electronics, and gaming merchandise. The company operates over 5,000 stores worldwide and has transitioned towards e-commerce and digital services. Understanding GME’s business model is crucial for analyzing its stock performance.

GME’s Global Impact

Before focusing on the German market, it’s essential to understand GME’s global influence. This section provides an overview of GME’s operations, its role in the gaming industry, and its influence on global retail and financial markets.

Entry into the German Market

GameStop entered the German market as part of its international expansion strategy. This section discusses the timeline and rationale behind GME’s entry into Germany, including market conditions and strategic goals that drove the decision.

Performance of GME in the German Market

GME’s performance in Germany has been influenced by various factors, from local market trends to global events. This section analyzes GME’s sales, market share, and overall performance in the German market, providing insights into its success and challenges.

Market Trends Influencing GME in Germany

The German market for gaming and consumer electronics is dynamic and influenced by technological advancements, consumer behavior, and economic conditions. This section examines the trends that impact GME’s operations in Germany, such as the rise of digital gaming and changing consumer preferences.

GME’s Competitive Landscape in Germany

GME faces competition from other retailers and digital platforms in Germany. This section evaluates the competitive landscape, identifying key competitors and analyzing GME’s market position relative to these players. Understanding the competition is essential for assessing GME’s strengths and weaknesses.

Regulatory Environment in Germany

The regulatory environment can significantly impact GME’s operations. This section explores the regulatory landscape in Germany, including trade regulations, consumer protection laws, and other factors that affect GME’s business activities.

Investor Sentiment Towards GME in Germany

Investor sentiment plays a crucial role in stock performance. This section delves into how German investors perceive GME, analyzing trading volumes, investor behavior, and market sentiment towards the stock in Germany.

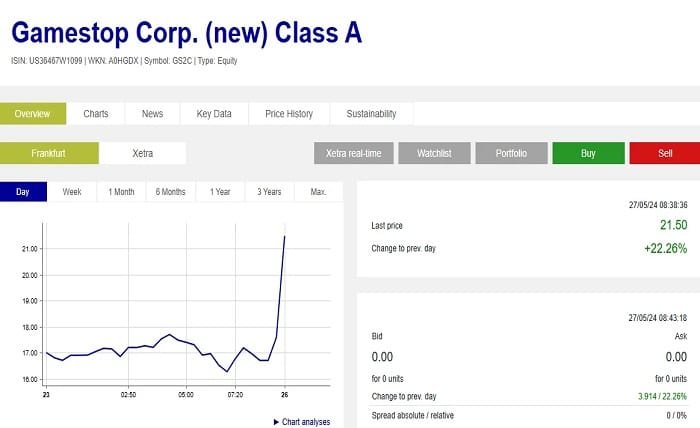

GME Stock Performance on German Exchanges

GME is traded on various German exchanges, including the Frankfurt Stock Exchange. This section provides a detailed analysis of GME’s stock performance on these exchanges, identifying key trends and significant events that have influenced its price movements.

Strategic Initiatives and Future Plans

Understanding GME’s strategic initiatives and future plans is essential for evaluating its investment potential. This section discusses GME’s strategies in the German market, including store expansions, digital transformation efforts, and partnerships.

Risks and Challenges for GME in Germany

Investing in GME involves understanding the risks and challenges the company faces in Germany. This section outlines potential risks, such as market competition, regulatory changes, and economic conditions. Evaluating these risks is crucial for making informed investment decisions.

How to Invest in GME in Germany

For those interested in investing in GME, this section offers practical advice on how to buy shares in the German market. It covers the steps to open a brokerage account, different investment strategies, and tips for building a diversified portfolio that includes GME.

Conclusion

GME’s presence in the German market represents a significant aspect of its international operations. Despite the challenges and risks, the company’s strategic initiatives and market potential make it an intriguing prospect for investors. By thoroughly understanding GME’s performance, market trends, and future plans, potential investors can make informed decisions.

FAQs

1. What is GME’s primary business focus? GME, or GameStop Corp., is a global retailer of video games, consumer electronics, and gaming merchandise, with a growing focus on e-commerce and digital services.

2. How has GME performed in the German market? GME has seen varying performance in Germany, influenced by local market trends, consumer behavior, and broader economic conditions.

3. Who are GME’s main competitors in Germany? GME faces competition from other gaming and electronics retailers, as well as digital platforms, in the German market.

4. What are the risks of investing in GME in Germany? Risks include intense market competition, regulatory changes, and economic fluctuations that can impact GME’s operations and stock performance in Germany.

5. How can I invest in GME stock in Germany? To invest in GME stock in Germany, you need to open a brokerage account with access to German exchanges, research the stock, and consider using investment strategies like dollar-cost averaging or portfolio diversification.